Van and Shapiro formed a partnership. As part of the formation, Van contributed equipment whose cost to her was $60,000, with accumulated depreciation for tax purposes of $36,000. The partnership awarded her $40,000 towards her partnership interest for the equipment. The partnership assumed $10,000 of Shapiro's personal debts when she was admitted into the partnership.

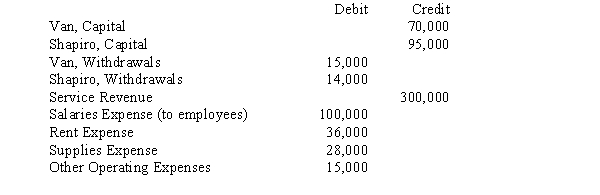

After one year of operation, the partnership had the following partial trial balance:

Partners split profits as follows:

Partners split profits as follows:

(1) A salary of is paid to Van.

(2) Remaining profits (or losses) are split to Van, the remainder to Shapiro. Required:

Calculate the two partners' ending capital balances.

Definitions:

Culturagrams

A tool used in social work and counseling to gather detailed information about a client's cultural background and how it affects their life experience and behavior.

Family Interaction

The dynamics, communication, and relationships among members within a family unit.

Effective Communication

The successful conveyance and exchange of ideas, thoughts, or feelings, ensuring clarity, understanding, and achieving the desired outcome.

Married Couple

Two individuals legally united in marriage, who share a personal and intimate relationship.

Q14: The following summary events are for the

Q16: Which one of the following statements is

Q17: Kentucky Blue, Inc., a lawn care service

Q26: Key characteristic of the statement of net

Q30: The main difference between an agency fund

Q43: Which term is described as the ability

Q52: What type of thinking is inherent in

Q53: What does research indicate about the display

Q73: Civil courage refers to enforcing societal or

Q77: Why was The Life Orientation Test (LOT)