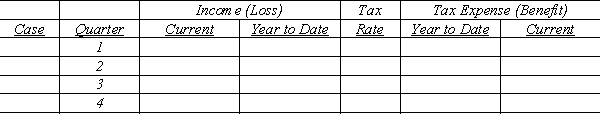

Consider the following:

Case A

Income (loss) for quarters 1 through 4 is ($50,000), $30,000, $40,000, and $40,000, respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be $20,000. No carryback benefit exists, and any future annual benefit is uncertain.

Case B

Assume the same facts as in Case A. However, at the end of quarters 1 through 3, annual income is estimated to be $40,000.

Case C

Quarterly income (loss) levels were $15,000, ($35,000), ($75,000), and $25,000. A yearly operating loss of $70,000 was anticipated throughout the year. Prior years' income of $28,000 is available for carryback. The same tax rates were relevant to the carryback period

Required:

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

Definitions:

Dream Work

A psychoanalytic concept referring to the process by which the unconscious mind alters the manifest content of dreams to conceal their real meaning.

Royal Road

A metaphor used in various contexts to indicate a direct or easy path to achieving a goal; historically related to Freud's description of dreams.

Gestalt Therapy

A type of counseling that highlights the importance of taking personal accountability, concentrating on the client's current experiences, the connection between the therapist and the client, the impact of the environment and social settings on a person's life, and the adjustments individuals make in response to their life circumstances.

Impasses

Situations or points in a process where no progress is possible; stalemates.

Q6: The partnership of Able, Bower, and

Q9: Which of the following people exemplifies characteristics

Q18: Other Operating Revenue includes:<br>A) revenues from outpatient

Q21: The governmental Accounting Standards Board has stated

Q23: Which of the following results in dissolution

Q32: The following is the priority sequence in

Q33: Equipment with a fair value of

Q33: On July 1, 20X5, Rhodes City approved

Q42: The doctrine of marshaling of assets<br>A) is

Q57: Whether an event is perceived as painful