Lion Corporation, a U.S. firm, entered into several foreign currency transactions during the year. Determine the effect of each transaction on net income for that current accounting year only. Bear has a June 30 year end.

Required:

a.

On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars. Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.

b.

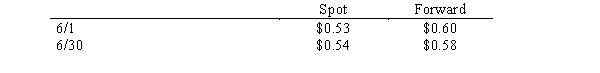

On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm. Bear paid for the computer on August 1. On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days. Exchange rates are as follows:

Discount rate = 6%

Discount rate = 6%

c.

On June 1, Lion purchased an option to sell 100,000 FC in 60 days to hedge a forecasted sale to a customer. The option sold for a premium of $6,500 and a strike price of $1.20. The value of the option 6/30 was $12,500. The spot rate on June 1 was $1.19 and $1.25 on June 30.

Definitions:

Transverse Scapular Vein

A vein that drains blood from regions near the scapula and upper shoulder, contributing to venous circulation in that area.

Radial Vein

A vein that accompanies the radial artery and is responsible for draining blood from the lateral aspect of the forearm.

Postcava

Another term for the inferior vena cava, the large vein that carries deoxygenated blood from the lower half of the body to the right atrium of the heart.

Precava

Often referred to as the superior vena cava, it is a large vein that carries deoxygenated blood from the upper body to the heart.

Q1: Consider the following events:<br>a. A portion of

Q6: On the financial statements of a not-for-profit

Q6: Rankin City established a Central Printing and

Q7: Goodwill represents the excess cost of an

Q10: The best definition for direct quotes would

Q17: Which of the following is an expenditure

Q22: Considering the study on the pattern of

Q26: Rogers, Davis, and Smukalla have capital balances

Q30: A French subsidiary of a U.S. firm

Q40: Depreciation Expense is recorded in which of