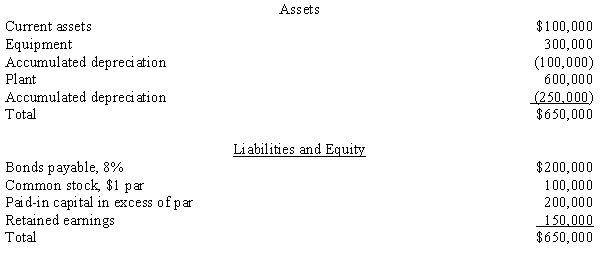

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash. The balance sheet for the Don Company on the date of acquisition showed the following:

Required:

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.

The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.

The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.

There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.

There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a nontaxable exchange.

Definitions:

First Marriage

The initial matrimonial union of an individual, before any potential subsequent marriages.

Young People

Individuals in their late childhood to early adulthood, often considered to encompass teenagers and those in their early 20s.

Careers

Long-term occupations or professions, often involving specialized training or education, and followed as one's lifework.

Hurricanes

Powerful tropical storms characterized by strong winds and heavy rain, usually forming over warm ocean waters.

Q5: Which of the following statements about self-efficacy

Q12: In a not-for-profit organization, depreciation on capital

Q16: Hugh, Inc. purchased merchandise for 300,000 FC

Q18: Other Operating Revenue includes:<br>A) revenues from outpatient

Q27: Diamond acquired Heart's net assets. At

Q28: Which personality factors were found to be

Q35: An American firm owns 100% of a

Q39: For each of the following account balances,

Q52: Refer to Palm and Star. The elimination

Q67: Which of the following statements is true