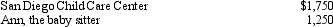

Marge and Lester file a joint tax return for 2011,with adjusted gross income of $33,000.Marge and Lester earned income of $20,000 and $12,000 respectively,during 2011.In order for Marge to be gainfully employed,they pay the following child care expenses for their 4-year-old son,Kevin:  Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Definitions:

Sweetener

A substance used to provide sweetness to foods or beverages, often with fewer calories compared to regular sugar, including natural and artificial types.

Ribonucleosides

Compounds consisting of a nucleoside attached to a ribose sugar, which are basic building blocks of RNA.

Residue Segment

A portion of a macromolecule, particularly in biopolymers, consisting of a sequence of monomers covalently bonded together.

DNA Sequence

The precise order of nucleotides (adenine, thymine, guanine, and cytosine) within a DNA molecule, determining genetic information.

Q8: Cost,Volume,Profit Analysis<br>Kalifo Company manufactures a line of

Q8: In drought conditions when soils are dry

Q9: Which of the following statements is correct?<br>A)The

Q23: If the proptoplast of plant cell A

Q26: The female gametophyte of flowering plants is

Q30: When an electron is added to copper

Q41: Purulent<br>A)to tie off or bind<br>B)removal of a

Q65: Select the term that is spelled correctly:<br>A)

Q139: Inflammation of the penis<br>A)androgen<br>B)balanitis<br>C)cryogenic surgery<br>D)cryptorchism<br>E)epididymitis<br>F)gonorrhea<br>G)hydrocele<br>H)orchiectomy<br>I)orchitis<br>J)prostatitis<br>K)prostatectomy<br>L)seminiferous tubules

Q195: Malignant tumor of the male gonad<br>A)carcinoma of