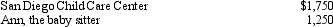

Marge and Lester file a joint tax return for 2011,with adjusted gross income of $33,000.Marge and Lester earned income of $20,000 and $12,000 respectively,during 2011.In order for Marge to be gainfully employed,they pay the following child care expenses for their 4-year-old son,Kevin:  Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Assuming they do not claim any other credits against their tax,what is the amount of the child and dependent care credit they should report on their tax return for 2011?

Definitions:

Fixed Component

A portion of a cost that remains constant regardless of the level of production or sales volume, such as rent, salaries, and insurance.

Mixed Cost

A cost composed of a fixed and variable component, changing with the level of activity but also containing a constant element.

Escrows Completed

Typically, the term "escrow" refers to a financial arrangement where a third party holds and regulates the payment of funds required for two parties involved in a given transaction. "Escrows Completed" could refer to transactions that have successfully met their conditions and been finalized, although this is not a standard accounting or financial term.

Variable Cost

Costs that vary directly with the level of production or output.

Q4: Which is not true about the higher

Q10: What is the name given to plants

Q14: Of the following expenses,which is considered to

Q16: galact/o and lact/o mean: _

Q20: For 2011,Till and Larry had adjusted gross

Q43: What does the virus that causes the

Q55: Corn seed is classified as which of

Q56: CO<sub>2</sub> given off _.

Q72: Select the term that is spelled correctly:<br>A)

Q118: Act of giving birth:<br>A) parrition<br>B) parturition<br>C) partrition