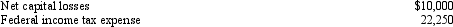

For 2011,the Butternut Corporation has net income on its books of $75,000,including the following items:  Federal tax depreciation exceeds the depreciation deducted on the books by $7,250.What is the corporation's taxable income?

Federal tax depreciation exceeds the depreciation deducted on the books by $7,250.What is the corporation's taxable income?

Definitions:

Relevant Range

The range of activity levels within which the assumptions about fixed and variable cost behaviors hold true, critical for accurate budgeting and decision-making.

Average Costs

The total costs divided by the number of goods produced, used to calculate the per-unit cost of production.

Incremental Manufacturing Cost

The additional costs incurred when increasing production by one unit.

Production Increase

The rise in the quantity of goods produced by a company or economy over a specific time period.

Q1: Morton has a Roth IRA to which

Q2: Olive and Marvin file a joint income

Q3: Product Profitability and Mix - Calculating Variable

Q8: Perineum: _

Q14: A. menarchy<br>B. menarche<br>A or B: _ meaning:

Q39: Vaginal discharge, pain in the LLQ and

Q56: Sac of clear fluid in the scrotum<br>A)carcinoma

Q116: TURP: _

Q126: Pair of exocrine glands near the male

Q126: Development of enlarged ("female") breasts in a