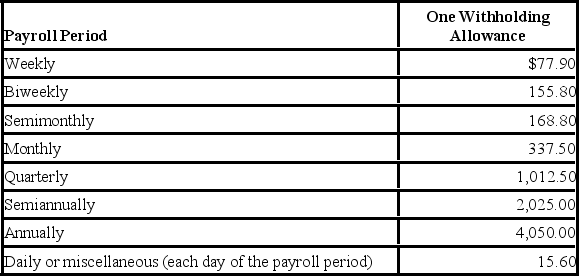

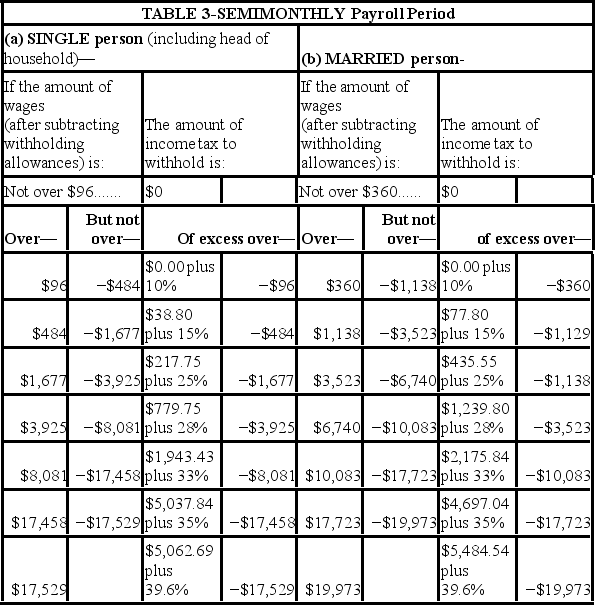

Collin is a full-time exempt employee in Juneau, Alaska, who earns $135,000 annually and has not yet reached the Social Security wage base. He is single with 1 withholding allowance and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Collin has a child support garnishment of $300 per pay period. What is his net pay? (Use the percentage method. Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for One Withholding Allowance

Federal Income tax using percentage method

Definitions:

Opiates

Natural or synthetic substances that are used for their pain-relieving properties, but can also lead to addiction and abuse.

Heroin

A highly addictive opioid drug derived from morphine, often used illicitly for its euphoric effects.

Problems Associated

Issues or difficulties related to a particular subject, situation, or condition that may require attention or resolution.

Night Terrors

A sleep disorder causing feelings of panic or dread, typically occurring during non-REM sleep stages and resulting in loud screams or movements.

Q1: The concept of "personalistic ethics" states that

Q11: Mediation is more often successful in the

Q12: Heritability refers to the extent to which<br>A)

Q14: A payroll review process increases in complexity

Q18: Which of the following is/are hallmarks of

Q21: Alcohol has the most profound effect on<br>A)

Q33: Grainne is an inside salesperson who earns

Q42: Projection occurs when people assign to others

Q54: _ allows firms to allocate costs accurately

Q57: The cognitive perspective in psychology focuses on