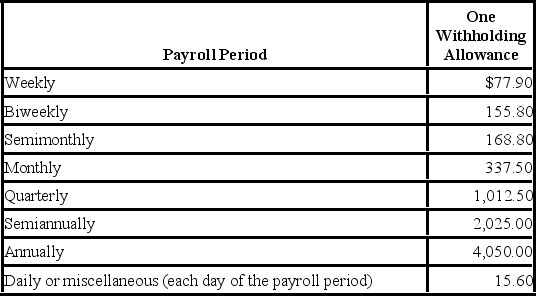

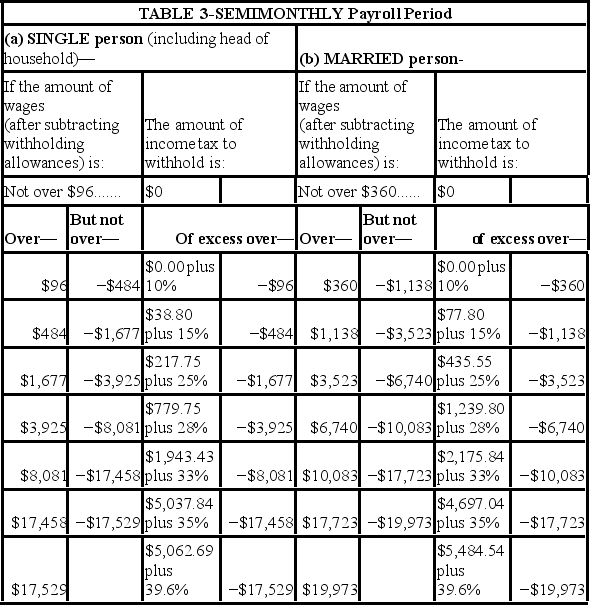

Danny is a full-time exempt employee in Alabama, where the state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) . Assuming that he has no other deductions, what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax. Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

Definitions:

Expected Value

The average outcome or mean of a random variable, calculated as the sum of all possible values each multiplied by its probability of occurrence.

Confidence Interval

A gamut of statistical values, extrapolated from sample data, predicted to likely retain the value of an undisclosed population parameter.

Gross Revenue

The total income generated by a business before any deductions are made for expenses.

Big-Name Stars

Prominent and well-recognized celebrities or personalities, particularly in entertainment, who can significantly influence projects.

Q2: In its earliest days, psychology was defined

Q19: What is the difference in pay practices

Q27: The IRS uses EINs to track employers

Q27: The fundamental questions of ethical conduct arise

Q28: When negotiations are unable to reach an

Q29: In which type of retirement plan does

Q36: Faith, the accountant for Harris's Meats, filed

Q43: Robin, 18 years of age, is an

Q51: Humanistic psychologists focused attention on the importance

Q92: (Close-Up) A major principle underlying the SQ3R