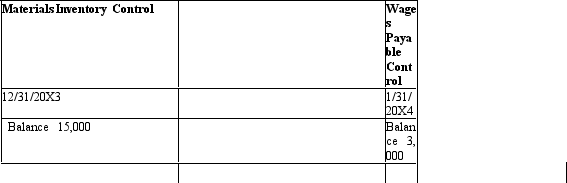

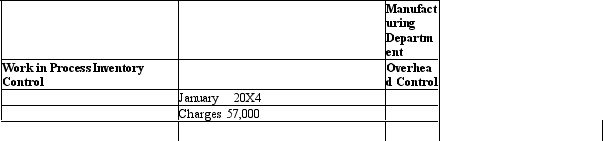

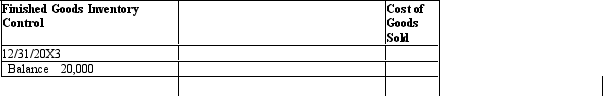

You are asked to bring the following incomplete accounts of Denson Printing, Inc. up to date through January 31, 20X4. Consider the data that appear in the T-accounts as well as additional information given in items (a) through (i).

Denson's job-order costing system has two direct cost categories (direct material and direct manufacturing labor) and one indirect cost pool (manufacturing overhead, which is allocated using direct manufacturing labor costs).

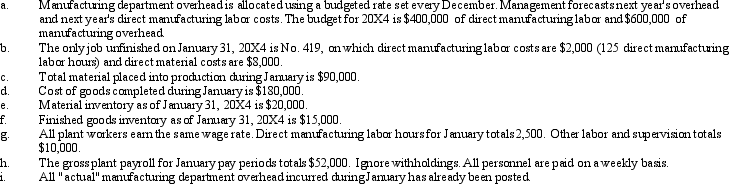

Additional Information:

Additional Information:

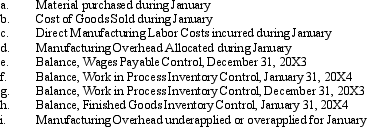

Required:

Required:

Definitions:

Actual Costs

The genuine costs incurred in the production of goods or services, including all direct labor, materials, and overhead expenses.

Motivational Effects

The impact of various factors, such as incentives or goal setting, on an individual's willingness to perform or achieve tasks.

Unfavourable Price Variance

The difference between the actual price paid for something and its standard cost, when the actual price is higher.

Price Variance

The difference between the actual cost of a good or service and its standard or expected cost.

Q7: Weaknesses of the high-low method include all

Q14: Accounting for product costs in a JIT

Q63: The distinction between direct and indirect costs

Q71: Costs incurred for monitoring or inspecting products

Q76: Guthrie Corporation The following information is available

Q160: In a perpetual inventory system, a transaction

Q163: Discuss actual costing, normal costing, and standard

Q166: Which of the following costing systems allows

Q173: Overapplied factory overhead that is material in

Q200: Reichs Company The following information is for