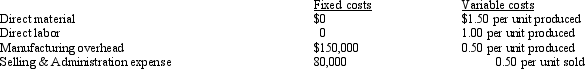

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. What is the net income under absorption costing?

Definitions:

Transfer Price

The price at which goods and services are sold between divisions within the same company.

General Rule

A basic or principal rule that provides guidance or policy in a given area or operation.

Transfer Price

The price at which goods and services are transferred between departments or subsidiaries of the same company.

Variable Cost

Costs that vary directly with the level of production or sales volume, such as raw materials or direct labor.

Q10: In an open-book management setting, financial information

Q30: To what does workforce diversity refer?

Q57: _ is a "pull" system of production

Q64: Webb Company. Webb Company uses a job-order

Q84: Absorption costing conforms with generally accepted accounting

Q92: Bottlenecks are<br>A) machine constraints in the production

Q104: A search for various feasible combinations of

Q153: Meade Company makes small metal containers. The

Q164: With JIT manufacturing, which of the following

Q165: When manufacturing overhead is charged to a