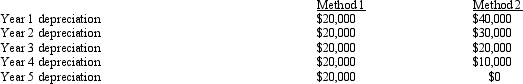

Terrell Industries is considering two alternative ways to depreciate a proposed investment. The investment has an initial cost of $100,000 and an expected five-year life. The two alternative depreciation schedules follow:  Assuming that the company faces a marginal tax rate of 40 percent and has a cost of capital of 10 percent, what is the difference between the two methods in the present value of the depreciation tax benefit? Present value tables or a financial calculator are required.

Assuming that the company faces a marginal tax rate of 40 percent and has a cost of capital of 10 percent, what is the difference between the two methods in the present value of the depreciation tax benefit? Present value tables or a financial calculator are required.

Definitions:

Nursing Theorist

A professional in the field of nursing who develops theories on how to provide better care and improve patient outcomes based on specific philosophical perspectives.

Counselling Role

The professional guidance provided by a counselor, focusing on helping individuals resolve personal, social, or psychological challenges.

Palliative Client

A patient receiving palliative care, which focuses on providing relief from the symptoms and stress of a serious illness, emphasizing comfort and quality of life.

Foul Language

The use of offensive, rude, or vulgar words in speech or writing.

Q11: To identify costs that relate to a

Q40: Non-financial measures are generally less timely than

Q52: Which of the following would typically be

Q64: Can the performance evaluation measures (for autonomous

Q80: U-shaped groupings of workers and machines that

Q82: A quality audit involves a review of

Q124: Ongoing efforts to reduce costs, increase product

Q125: A major benefit of cost-based transfers is

Q130: In a just-in-time (JIT) environment, machines and

Q173: Using MACRS depreciation for tax purposes and