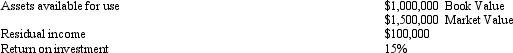

Global Electronics Company The Computer Division of Global Electronics Company had the following financial data for the year: Refer to Global Electronics Company. What was the Computer Division's segment income?

Refer to Global Electronics Company. What was the Computer Division's segment income?

Definitions:

AGI

An income calculation that includes all taxable income and is reduced by specific deductions, instrumental in determining tax obligations.

Foreign Taxes Paid

Taxes paid to a foreign government for income earned in that foreign country, which may be creditable or deductible on a U.S. tax return.

Itemized Deduction

Deductions that taxpayers can claim for certain personal expenses, instead of taking a standard deduction. These can include expenses for healthcare, taxes, interest, and gifts to charity.

Foreign Tax Credit

A nonrefundable tax credit for income taxes paid to a foreign government, aimed at reducing double taxation.

Q7: Identify and discuss how sales and costs

Q28: In a joint costing process, which of

Q57: An organizational unit whose manager is responsible

Q77: Brite Surface Company Brite Surface Company produces

Q85: When implementing TQM, an organization should establish

Q87: Ideal Homes Corporation<br>The Carpet Division of Ideal

Q101: Joint costs include all materials, labor and

Q110: The Cheesecake Division of Desserts Corporation has

Q154: A change in the discount rate used

Q176: Process quality yield reflects the proportion of<br>A)