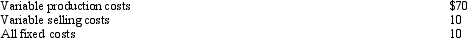

Dynamic Engine Corporation The Motor Division of Dynamic Engine Corporation uses 5,000 carburetors per month in its production of automotive engines. It presently buys all of the carburetors it needs from two outside suppliers at an average cost of $100. The Carburetor Division of Dynamic Engine Corporation manufactures the exact type of carburetor that the Motor Division requires. The Carburetor Division is presently operating at its capacity of 15,000 units per month and sells all of its output to a foreign car manufacturer at $106 per unit. Its cost structure (on 15,000 units) is: Assume that the Carburetor Division would not incur any variable selling costs on units that are transferred internally.

Assume that the Carburetor Division would not incur any variable selling costs on units that are transferred internally.

Refer to Dynamic Engine Corporation. What is the minimum of the transfer price range for a transfer between the two divisions?

Definitions:

Unit Product Cost

The total cost associated with manufacturing a single unit of product, inclusive of materials, labor, and overhead.

Net Operating Income

The profit a company has after subtracting its operating expenses from its revenue, excluding interest and taxes.

Absorption Costing

This method of product costing in the field of accounting takes into account all manufacturing-related expenditures, including direct materials, direct labor, and manufacturing overheads, both fixed and variable.

Absorption Costing

An accounting method that captures all of the manufacturing costs (both fixed and variable) in the cost of a product.

Q24: The minimum potential transfer price is determined

Q37: A binding contract between a company and

Q51: Sun Glo Company Sun Glo Company produces

Q62: The tax benefit from depreciation expense is

Q74: Brite Surface Company Brite Surface Company produces

Q91: Which of the following is not a

Q99: An organizational unit whose manager is solely

Q108: Briefly discuss the four decisions that management

Q156: The discount rate that causes the present

Q175: Hunt Corporation has a target return of