Hefner Corporation

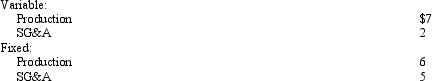

Hefner Corporation is comprised of two divisions: X and Y. X currently produces and sells a gear assembly used by the automotive industry in electric window assemblies. X is currently selling all of the units it can produce (25,000 per year) to external customers for $25 per unit. At this level of activity, X's per unit costs are:

Y Division wants to purchase 5,000 gear assemblies per year from X Division. Y Division currently purchases these units from an outside vendor at $22 each.

Y Division wants to purchase 5,000 gear assemblies per year from X Division. Y Division currently purchases these units from an outside vendor at $22 each.

Refer to Hefner Corporation. What will be the effect on overall corporate profits if the two divisions agree to an internal transfer of 5,000 units?

Definitions:

Stethoscope

A medical instrument for listening to the action of someone's heart or breathing.

Physician

A medical professional trained to diagnose, treat, and prevent illnesses, and provide patient care.

Month

A unit of time, typically used in calendars, that roughly corresponds to the period required for the moon to orbit the Earth.

Fontanels

Membranous regions found in the skull of infants; permit the skull to move through the birth canal.

Q4: Kelly Company Kelly Company is placing an

Q10: A measuring device that identifies what is

Q10: Why is it important for managers to

Q12: The world has essentially become smaller because

Q35: Information that is related to past events

Q59: In the future competitive environment, companies will

Q61: Melbourne Company Melbourne Company manufactures three products

Q68: Ezell Company has 20,000 units in inventory

Q93: The Precise Printing Corporation is contemplating the

Q113: Guthrie Wire Corporation<br>The Wire Products Division of