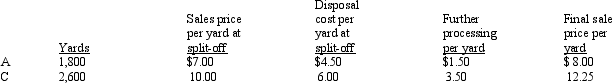

Johnson Company Ellis Company produces two products from a joint process: A and C. Joint processing costs for this production cycle are $9,000. If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company. Which products would be processed further?

Definitions:

Profit-Sharing Programs

A company policy where a portion of the company's profits is distributed to its employees, often based on their performance or as an incentive.

Organizational Performance

The measure of how effectively an organization meets its objectives and achieves its goals.

Profit-Sharing Program

A company program in which employees receive a portion of the company’s profits, typically as a part of their compensation package, to motivate and reward them for their contribution to the company's success.

Clear Goals

Well-defined, unambiguous objectives that are easy to understand and pursue.

Q14: Manufacturing cycle efficiency should be increased by

Q32: Executive Images Corporation produces two types of

Q43: Information about the life-cycle performance of a

Q54: Cost accounting standards<br>A) are legal standards set

Q77: A device that alters behavior if the

Q79: In linear programming, the equation that specifies

Q85: Which of the following statements is true

Q88: What are the functions of a mission

Q128: Which of the following steps in the

Q163: Carson Corporation Carson Corporation has three production