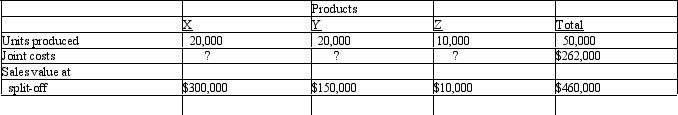

Kellman Company Kellman Company manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Joint costs were allocated using the sales value at split-off approach.

Joint costs were allocated using the sales value at split-off approach.

Refer to Kellman Company. The joint costs allocated to product Y were

Definitions:

Peter Drucker

A renowned management consultant, educator, and author, considered the father of modern management.

Delegation

The assignment of responsibility and authority to someone else while retaining ultimate accountability.

Accountable

Being responsible for one's actions and the outcomes of those actions, often involving an obligation to report, explain, or justify them.

Good Management

Refers to the process of effectively planning, organizing, leading, and controlling resources and tasks to achieve organizational goals.

Q2: Video Corporation Video Corporation has two product

Q53: The allocation of general overhead control costs

Q53: Manufacturing cycle efficiency is a measure of<br>A)

Q59: A responsibility accounting system should include the

Q70: Direct materials are normally considered batch-level costs.

Q79: Video Corporation Video Corporation has two product

Q126: The most valid reason for using something

Q134: Contracting with vendors outside the organization to

Q149: Girard Corporation Girard Corporation has two service

Q185: On a balanced scorecard, which of the