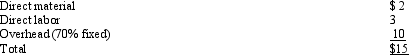

Waldrup Corporation Waldrup Corporation sells a product for $21 per unit, and the standard cost card for the product shows the following costs: Refer to Waldrup Corporation. Waldrup received a special order for 1,200 units of the product. The only additional cost to Waldrup would be foreign import taxes of $2 per unit. If Waldrup is able to sell all of the current production domestically, what would be the minimum sales price that Waldrup would consider for this special order?

Refer to Waldrup Corporation. Waldrup received a special order for 1,200 units of the product. The only additional cost to Waldrup would be foreign import taxes of $2 per unit. If Waldrup is able to sell all of the current production domestically, what would be the minimum sales price that Waldrup would consider for this special order?

Definitions:

Asset Turnover Ratio

A financial metric that measures the efficiency of a company in generating sales revenue from its investments in assets.

Perpetual Inventory System

A system for inventory accounting that immediately records inventory transactions, whether it's a sale or purchase, through computerized point-of-sale systems and software for managing enterprise assets.

Periodic Inventory System

An accounting method where inventory and the cost of goods sold are determined at the end of an accounting period.

Periodic Inventory System

An inventory accounting system that updates inventory balances and cost of goods sold at the end of an accounting period.

Q7: What are the six primary goals of

Q9: Atlanta Motors Atlanta Motors is trying to

Q22: If the firms in a market have

Q25: Video Corporation Video Corporation has two product

Q33: Joint costs may be allocated to by-products

Q36: In the exporting country, an export subsidy

Q42: If an import-competing firm is the only

Q43: A rational and systematic allocation base for

Q72: In evaluating the profitability of a specific

Q104: Joint cost allocation is useful for<br>A) decision