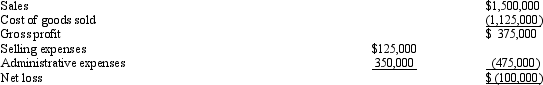

Calvert Company has 3 divisions: A, B, and C. Division A's income statement shows the following for the year ended December 31:  Cost of goods sold is 80 percent variable and 20 percent fixed. Of the fixed costs, 50 percent are avoidable if the division is closed. All of the selling expenses relate to the division and would be eliminated if Division A were eliminated. Of the administrative expenses, 85 percent are applied from corporate costs. If Division A were eliminated, Calvert's income would

Cost of goods sold is 80 percent variable and 20 percent fixed. Of the fixed costs, 50 percent are avoidable if the division is closed. All of the selling expenses relate to the division and would be eliminated if Division A were eliminated. Of the administrative expenses, 85 percent are applied from corporate costs. If Division A were eliminated, Calvert's income would

Definitions:

Married Filing Jointly

A tax filing status for married couples that allows them to combine their tax obligations into a single return.

Tax Equation

A mathematical formula used to calculate the amount of taxes owed based on income, deductions, and applicable tax rates.

Net Pay

The amount of money a worker takes home after all deductions, such as taxes and retirement contributions, have been subtracted from the gross salary.

Social Security Tax

The amount of Social Security a worker pays depends on the Social Security percentage and the maximum taxable income for that year; the amount is split between the employee and the employer.

Q8: One advantage of the specialization that results

Q14: If a firm's output less than doubles

Q30: The net realizable value approach mandates that

Q70: Transfer prices can be used to promote

Q78: Relating resource consumption and cost to alternative

Q84: A value chart indicates<br>A) all steps in

Q90: Financial accounting is highly regulated by rules

Q94: Grant Corporation Grant Corporation distributes its service

Q145: When using a negotiated transfer price, a

Q170: Activity-based costing is appropriate for a company