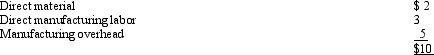

Travers Corporation is working at full production capacity producing 10,000 units of a unique product, RST. Manufacturing costs per unit for RST follow:

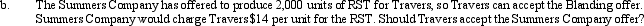

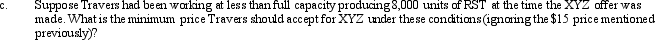

The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The non-manufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, Blanding Company, has asked Travers to produce 2,000 units of a modification of RST to be called XYZ. XYZ would require the same manufacturing processes as RST. Blanding Company has offered to share equally the non-manufacturing costs with Travers. XYZ will sell at $15 per unit.

The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The non-manufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, Blanding Company, has asked Travers to produce 2,000 units of a modification of RST to be called XYZ. XYZ would require the same manufacturing processes as RST. Blanding Company has offered to share equally the non-manufacturing costs with Travers. XYZ will sell at $15 per unit.

Required:

Definitions:

Bad Debt Expense

An expense recorded to account for receivables that are expected not to be collected.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services that have been delivered or used but not yet paid for.

Net Sales

The total revenue a company generates from sales after subtracting returns, allowances, and discounts.

Increase in Accounts Receivable

A situation where the amount of money owed by customers to a company grows due to sales on credit outpacing payments received.

Q27: Focus on cost control and assessing core

Q29: _ refers to the number of products

Q33: _ programming relates to a variety of

Q47: Levine Company Levine Company produces two products:

Q51: A commonly recognized critical success factor for

Q62: One major difference between financial and management

Q71: Define confrontation strategy and indicate why many

Q72: Two methods of allocating joint costs to

Q136: The amount of time between the development

Q148: Cost allocation bases in activity-based costing should