Seattle Grace Corporation manufactures two models of a medical device: Model 101 and Model 102.

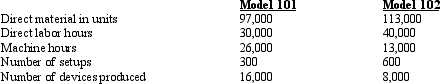

Below is the current year production data for the company:

The 210,000 units of material had a total cost of $1,365,000. Direct labor is $17 per hour.

The 210,000 units of material had a total cost of $1,365,000. Direct labor is $17 per hour.

The company has total overhead production costs of $1,850,000.

a. If Seattle Grace Corporation applies factory overhead using direct labor hours, compute the total production cost and the unit cost for each model

b. If Seattle Grace Corporation applies factory overhead using machine hours, compute the total production cost and the unit cost for each model.

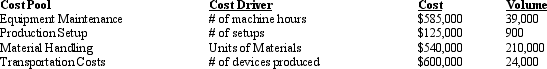

c. Assume that Seattle Grace Corporation has established the following activity centers, costs drivers, and costs to apply factory overhead.

Compute the total cost and the unit cost for each model.

Compute the total cost and the unit cost for each model.

d. Explain why the unit cost for each model is different across the three methods of overhead application. How can such information benefit an organization?

Definitions:

Cash Payment

A financial transaction where an exchange of money occurs to settle a debt or purchase goods or services.

Common Stock

Equities representing ownership interests in a corporation, entitling holders to dividends and voting rights.

General Journal

A comprehensive listing of all a company’s financial transactions, recorded in chronological order.

Cash Investment

Placement of funds into a venture or asset with the expectation of generating income or profit.

Q3: The objective in solving the linear programming

Q8: In general, the development of underground economic

Q25: Kenwood Electronics Corporation Kenwood Electronics Corporation manufactures

Q56: A tax of 20 percent per unit

Q59: The objective function and the resource constraints

Q64: Explain how Brazil was able to reduce

Q68: Ezell Company has 20,000 units in inventory

Q89: As of 2013, how large is the

Q139: Use of activity-based costing and activity-based management

Q143: Video Corporation Video Corporation has two product