Best Brew Corporation manufactures two brands of wine: Regular and Extra Rich

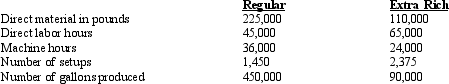

Below is the current year production data for the company:

The 335,000 pounds of material had a total cost of $753,750. Direct labor is $21 per hour.

The 335,000 pounds of material had a total cost of $753,750. Direct labor is $21 per hour.

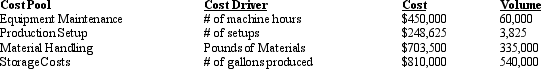

The company has total overhead production costs of $2,212,125.

a. If Best Brew Corporation applies factory overhead using direct labor hours, compute the total production cost and the unit cost for each brand

b. If Best Brew Corporation applies factory overhead using machine hours, compute the total production cost and the unit cost for each brand.

c. Assume that Best Brew Corporation has established the following activity centers, cost drivers, and costs to apply factory overhead.

Compute the total cost and the unit cost for each brand.

Compute the total cost and the unit cost for each brand.

d. Explain why the unit cost for each model is different across the three methods of overhead application. How can this information benefit the organization?

Definitions:

Disposable Income

Funds permissible for households' usage in saving and spending post the accounting of income taxes.

Disposable Income

The net income available to households or individuals after accounting for taxes, which can be spent on consumption or savings.

Consumption

The use of goods and services by households, one of the primary components that determine the overall level of economic activity in an economy.

Billion

A numerical value represented as 1,000 million (1,000,000,000) in the short scale, commonly used in financial and demographic statistics.

Q6: The share of _ goods in employment

Q8: One advantage of the specialization that results

Q12: The meaning of "terms of trade" is<br>A)

Q23: The proportion of value added processing time

Q28: Which of the following are relevant in

Q31: Moreno Company makes ten different styles of

Q40: Firms that produce _ products must be

Q55: The two deadweight triangles are the Consumption

Q98: Nature's Grain Corporation<br>Nature's Grain Corporation grows grain

Q126: The actual time it takes to perform