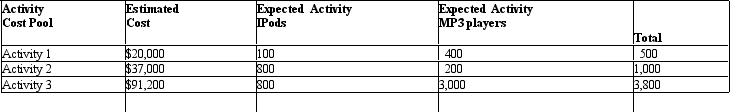

Parrish Company Parrish Company uses activity-based costing. The company produces two products: IPods and MP3 players. The annual production and sales volume of IPods is 8,000 units and of MP3 players is 6,000 units. There are three activity cost pools with the following expected activities and estimated total costs: Refer to Parrish Company. Using ABC, the cost per unit of MP3 players is approximately:

Refer to Parrish Company. Using ABC, the cost per unit of MP3 players is approximately:

Definitions:

Interest Rate Swap

A financial derivative contract in which two parties agree to exchange future interest rate payments, typically one fixed-rate and one variable-rate.

Fair Value

A financial term referring to the estimated market value of an asset, based on current market prices.

Available For Sale

A classification for financial assets indicating that they are neither held for trading purposes nor intended to be held to maturity, implying they can be sold to meet liquidity needs or strategic goals.

Idle Funds

Money that is not currently invested or used in transactions, potentially earning no interest or profit.

Q11: How would you define exchange control?<br>A) The

Q17: If the market for products produced by

Q24: Which of the following variables is associated

Q39: In an outsourcing decision, avoidable fixed costs

Q52: In the four-quadrant diagram of the specific

Q60: Sun Glo Company Sun Glo Company produces

Q62: Levine Company Levine Company produces two products:

Q99: Ralph Parrish operates a woodworking shop that

Q121: In a make or buy decision, the

Q139: Use of activity-based costing and activity-based management