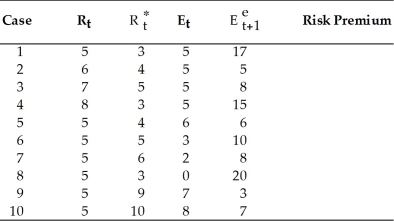

Does the interest rate parity hold in each of the following cases by using the formula

Rt - Rt

= (Ee+1 - Et)/Et

= (Ee+1 - Et)/Et

? In case it does not hold, calculate the risk premium.

? In case it does not hold, calculate the risk premium.

1. Rt = 5,  = 3, Et = 5,

= 3, Et = 5,  = 17

= 17

2. Rt = 6,  = 4, Et = 5,

= 4, Et = 5,  = 5

= 5

3. Rt = 7,  = 5, Et = 5,

= 5, Et = 5,  = 8

= 8

4. Rt = 8,  = 3, Et = 5,

= 3, Et = 5,  = 15

= 15

5. Rt = 5,  = 4, Et = 6,

= 4, Et = 6,  = 6

= 6

6. Rt = 5,  = 5, Et = 3,

= 5, Et = 3,  = 10

= 10

7. Rt = 5,  = 6, Et = 2,

= 6, Et = 2,  = 8

= 8

8. Rt = 5,  = 3, Et = 0,

= 3, Et = 0,  = 20

= 20

9. Rt = 5,  = 9, Et = 7,

= 9, Et = 7,  = 3

= 3

10. Rt = 5,  = 10, Et = 8,

= 10, Et = 8,  = 7

= 7

Definitions:

Stock Dividend

A dividend payment made in the form of additional shares rather than a cash payout, representing a reinvestment of a company’s earnings.

Market Value

The current price at which an asset or service can be bought or sold in a marketplace.

Treasury Stock

Stocks that the company originally sold and then bought back, decreasing the number of shares available for trade in the public market.

Cash Dividend

A distribution of earnings made by a company to its shareholders, typically in the form of profits.

Q7: The pauper labor and the exploitation arguments<br>A)

Q10: "Bank failure may not be limited to

Q10: Imagine that the economy is at a

Q15: Explain why the oil price shocks after

Q20: The overall welfare effects of trade are

Q22: Which of the following is most likely

Q22: Refer to above figure. Imagine that the

Q35: Which of the following statements is the

Q103: The interest parity condition requires that:<br>A) all

Q143: The AA schedule shows<br>A) interest rate and