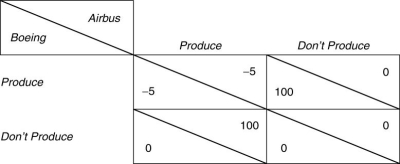

-Refer to the above table. Suppose both governments offer their respective company a $10 million subsidy.

Definitions:

Mean-Variance Efficient Portfolio

A Mean-Variance Efficient Portfolio is an investment strategy that aims to optimize the balance between expected return and risk, as defined by the portfolio's volatility.

Single-Index Structure

A model used in finance to describe the returns of a security as a function of a single market index.

Expected Returns

A rephrased definition for Expected Return: The anticipated income or profit from an investment over a specific period, considering various possible scenarios and their probabilities.

Variances of Returns

A statistical measure of the dispersion of returns for a given security or market index, showing the degree of variation from the average.

Q1: What are the predictions for the long-run

Q2: The fact that articles of clothing sold

Q4: Cost-benefit analysis of international trade<br>A) is basically

Q6: One of the major issues that arose

Q22: If there is initially an<br>A) excess demand

Q38: Which one of the following statements is

Q48: Assume in a closed economy:<br>C = 40

Q51: Current account is given by the equation:<br>A)

Q51: Which one of the following expressions is

Q54: _ are graphics that can be incorporated