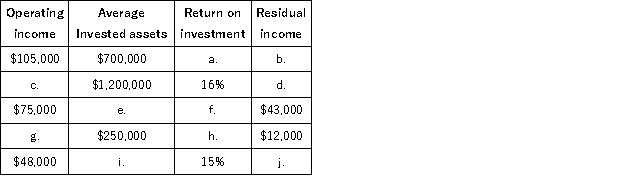

Eureka Corp. has a hurdle rate of 8%. Calculate the missing values on each line. (Each line is independent of the others).

Definitions:

Delinquent Taxes

Taxes that have not been paid by the due date, often incurring penalties and interest.

Salvaged Materials

Items or resources recovered from discarded or obsolete goods that can be reused or repurposed in production.

Depreciation Expense

An accounting method that allocates the cost of a tangible asset over its useful life, representing the reduction in value of an asset over time.

Operating Expenses

The costs associated with the day-to-day operations of a business, including rent, utilities, salaries, and office supplies, but excluding the cost of goods sold.

Q27: During the current year, Todd Electronics had

Q38: The standard labor rate is:<br>A) the expected

Q84: The introductory phase of a company's life

Q88: Spice Company has two divisions, Parsley and

Q93: Bonnie Company has a direct labor standard

Q102: Jerome Corp. has fixed costs of $500,000

Q120: Ivory Inc. has forecast purchases on account

Q121: Creating a budget is an important part

Q164: Ashley Co. uses the direct method in

Q203: When the indirect method is used to