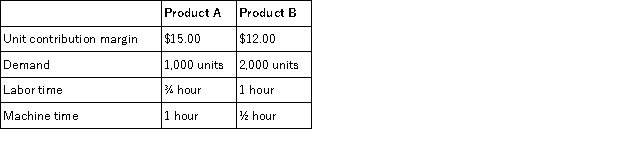

Spring, Inc. manufactures two products. It currently has 1,000 hours of direct labor and 2,000 hours of machine time available per month. The table below lists the contribution margin, labor and machine time requirements, and demand for each product.  How much of each product should Spring manufacture per month?

How much of each product should Spring manufacture per month?

Definitions:

FUTA Tax

The Federal Unemployment Tax Act tax, which is imposed on employers to fund state workforce agencies.

SUTA Tax

State Unemployment Tax Act tax, which employers pay to the state to fund unemployment benefits.

Income Tax Withholding

The process by which employers withhold a portion of employees' salaries or wages to pay directly to the government as an advance payment of income tax.

Payroll Tax Expense

Taxes that are incurred by an employer based on the wages and salaries paid to employees, including social security taxes, Medicare taxes, and unemployment taxes.

Q35: Avocado Company has an operating income of

Q39: Cricket Company has identified seven activities as

Q58: Cotton Corp. currently makes 10,000 subcomponents a

Q62: Ironwood Inc. has a variable cost ratio

Q74: Frontier Corp. sells units for $50, has

Q75: Tulip Inc. uses standard costing, and its

Q79: Davenport Inc. has two divisions, Howard and

Q117: Which of the following is not a

Q120: Delaware Corp. prepared a master budget that

Q122: Complete the following chart by reconciling the