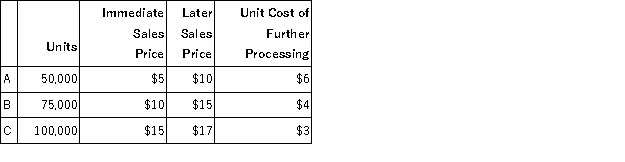

Legacy Company currently produces three products from a joint process. The joint process has total costs of $1,200,000 per month. All three products, A, B & C, are immediately saleable as they come out of the joint process. Alternatively, any of the products could continue on with additional processing and be sold as a more complete product. The following information is available:  a. Should Product A be sold immediately or sold after processing further? How much will the decision affect profit?

a. Should Product A be sold immediately or sold after processing further? How much will the decision affect profit?

b. Should Product B be sold immediately or sold after processing further? How much will the decision affect profit?

c. Should Product C be sold immediately or sold after processing further? How much will the decision affect profit?

Definitions:

Land Improvement Costs

Expenses incurred to enhance the usability and value of land, including landscaping, paving, and installing utilities, which can be capitalized.

Initiation Fees

Fees charged to initiate a service or to join a club or organization, often as a one-time cost for new members.

Endowment Contributions

Donations endowed to an institution meant for investment to provide a continuous source of funding.

Externally Restricted

Pertains to funds or resources that are subject to restrictions regarding their use, imposed by external parties or agreements.

Q1: A step cost:<br>A) is a fixed cost

Q26: Jupiter Co. applies overhead based on direct

Q40: Sanger Corp. uses a process costing system

Q65: When Greenway, Inc. sells 48,000 units, its

Q76: The cost estimating approach that uses the

Q80: Avocado Company has an operating income of

Q98: Acme Company sold 900 units for $110

Q110: Parsons and Sons Woodworks manufactures baseball bats

Q112: What component of the profit equation should

Q127: Meadow uses the high-low method. It had