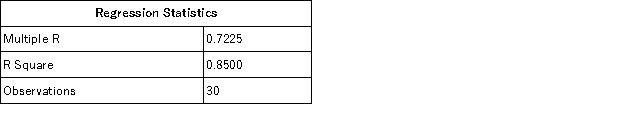

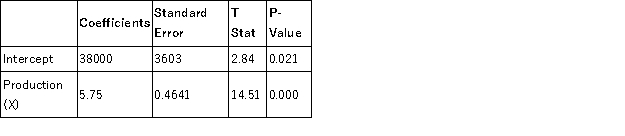

Newport, Inc. used Excel to run a least-squares regression analysis, which resulted in the following output:

a. What is Newport's total fixed cost?

a. What is Newport's total fixed cost?

b. What is Newport's variable cost per unit?

c. What total cost would Newport predict for a month in which they sold 5,000 units?

d. What proportion of variation in Newport's cost is explained by variation in production?

Definitions:

Percentage Increase

A measure of the degree to which a quantity grows over a period of time, calculated as the change in value divided by the original value and expressed as a percentage.

Interest Rate Price Risk

The potential for an investment’s value to change due to a fluctuation in the absolute level of interest rates, illustrating the inverse relationship between price and interest rates.

Zero Coupon Bond

A bond that does not pay periodic interest payments but instead is issued at a discount to its redemption value.

Foreign Bond

A bond issued in a domestic market by a foreign entity, in the domestic market’s currency, to raise capital from investors in that country.

Q5: Rapid Corp. sells its product for $200.

Q8: The formula for target sales is:<br>A) (Total

Q24: Participative budgeting is an approach to budgeting

Q30: Nora Inc. sells a single product for

Q41: Jefferson, Inc. produces two different products (Product

Q51: The cost of materials used on a

Q93: Pinnacle Consulting employs two CPAs, each having

Q97: When units are completed, the cost associated

Q105: Akron Corp. had a margin of safety

Q128: What determines the difference between a variable