Carter, Inc. produces two different products, Product A and Product

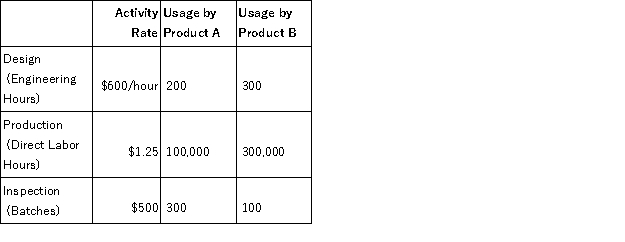

B. Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,000,000 across three activities: Design, Production, and Inspection. Under the traditional volume-based costing system, the predetermined overhead rate is $2.50/direct labor hour. Under the ABC system, the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a. Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b. Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system

c. Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d. Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e. Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Medicare

In the United States, Medicare is a government-run health insurance scheme designed for individuals who are 65 years of age or older, along with certain younger individuals who have disabilities.

Employee Benefits Expense

Costs incurred by a company to provide benefits to its employees, such as health insurance, retirement plans, and sick leave.

Medical Care

The provision of services by healthcare professionals to maintain, improve, or manage the health of individuals.

Insurance Benefits

Payments or services provided by insurance companies to policyholders when certain events or circumstances occur, outlined in an insurance policy.

Q1: A step cost:<br>A) is a fixed cost

Q24: Koebel Corp. uses a job order costing

Q59: Elk Corp. has sales of $300,000, a

Q66: Firms that use JIT often rely on:<br>A)

Q67: Contribution margin plus variable cost per unit

Q78: An activity that is performed to benefit

Q92: Russo Cabinets is a custom cabinet builder.

Q103: Which of the following represents the cost

Q108: A cost object is:<br>A) an item for

Q123: When forming activity cost pools, the goal