Carter, Inc. produces two different products, Product A and Product

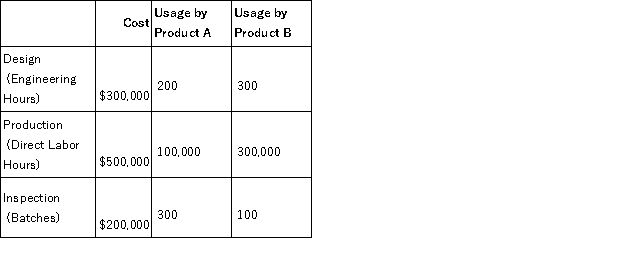

B. Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost across three activities: Design, Production, and Inspection. The cost of each activity and usage of the activity drivers are as follows:

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Carter manufactures 10,000 units of Product A and 7,500 units of Product B per month.

Required:

a. Calculate the predetermined overhead rate under the traditional costing system.

b. Calculate the activity rate for Design.

c. Calculate the activity rate for Machining.

d. Calculate the activity rate for Inspection.

e. Calculate the indirect manufacturing costs assigned to each unit of Product A under the traditional costing system.

f. Calculate the indirect manufacturing costs assigned to each unit of Product B under the traditional costing system

g. Calculate the indirect manufacturing costs assigned to each unit of Product A under the ABC system.

h. Calculate the indirect manufacturing costs assigned to each unit of Product B under the ABC system.

i. Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Definitions:

Addictive Drug

A substance that leads to compulsive use, despite harmful consequences, by altering the brain's natural reward pathways.

Illicit Drugs

Substances whose production, sale, or use is prohibited by law.

Nonsmoking Peers

Individuals in a social group who choose not to smoke cigarettes or use tobacco products.

Mescaline

A naturally occurring psychedelic compound found in certain cacti, known for inducing altered states of consciousness and visual hallucinations.

Q8: Effects of child abuse on young children

Q14: If an individual scores at 95 to

Q32: TryFit Co. uses process costing to account

Q51: Discuss the four recommended classification levels as

Q52: Which of the following is not a

Q58: The contribution margin ratio is:<br>A) the difference

Q64: A product should be processed further if

Q74: Sierra Co. has provided the following information:

Q100: Harbor Images has collected the following cost

Q107: Trout, Inc. prepared the following production report: