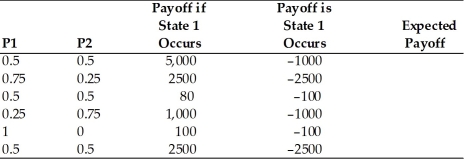

Calculate the expected payoff for the following cases with the formula: (P1)* (payoff if state 1)+ (P2)* (payoff if state 2),where P1 and P2 are the probabilities of state 1 and 2,respectively.

Definitions:

NPV

Net Present Value (NPV) is a financial metric used to evaluate the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows over a period of time.

MIRR

Modified Internal Rate of Return, a financial metric that accounts for the cost of capital and reinvestment of cash flows.

IRR

The interest rate at which the total present value of a project or investment's incoming and outgoing cash flows sum to zero.

WACC

A technique called Weighted Average Cost of Capital computes a firm’s cost of funds, taking into account the proportional weighting of various capital types.

Q5: In the short run,a permanent increase in

Q16: The Services sector has been steadily rising

Q17: Factor-intensity reversals describe a situation in which

Q28: In the Ricardian model,comparative advantage is likely

Q28: If assets are imperfect substitutes,then a decrease

Q30: Countries where investment is relatively<br>A)productive should be

Q31: In order to know whether a country

Q72: A central bank's international reserves consists of

Q105: What are the types of institution banks

Q141: In order to bring about a real