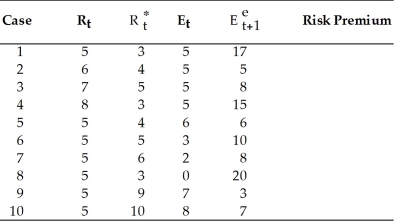

Does the interest rate parity hold in each of the following cases by using the formula

Rt - Rt

= (Ee+1 - Et)/Et

= (Ee+1 - Et)/Et

? In case it does not hold,calculate the risk premium.

? In case it does not hold,calculate the risk premium.

1.Rt = 5,  = 3,Et = 5,

= 3,Et = 5,  = 17

= 17

2.Rt = 6,  = 4,Et = 5,

= 4,Et = 5,  = 5

= 5

3.Rt = 7,  = 5,Et = 5,

= 5,Et = 5,  = 8

= 8

4.Rt = 8,  = 3,Et = 5,

= 3,Et = 5,  = 15

= 15

5.Rt = 5,  = 4,Et = 6,

= 4,Et = 6,  = 6

= 6

6.Rt = 5,  = 5,Et = 3,

= 5,Et = 3,  = 10

= 10

7.Rt = 5,  = 6,Et = 2,

= 6,Et = 2,  = 8

= 8

8.Rt = 5,  = 3,Et = 0,

= 3,Et = 0,  = 20

= 20

9.Rt = 5,  = 9,Et = 7,

= 9,Et = 7,  = 3

= 3

10.Rt = 5,  = 10,Et = 8,

= 10,Et = 8,  = 7

= 7

Definitions:

BCG Business Portfolio

A strategic analysis tool developed by the Boston Consulting Group that categorizes a company’s business units or products based on their market growth rate and market share.

SBUs

Strategic Business Units are organizational subunits of a larger corporation, each responsible for its own profitability and strategic direction.

Diversification Analysis

The process of evaluating the potential benefits of diversifying investments or product offerings in order to reduce risk and improve returns.

Current Markets

Refers to the existing market environment or segment where a company is actively engaged in selling its products or services.

Q1: Explain why,according to Feldstein and Horioka,one should

Q1: Which of the following is an assertion

Q2: Which one of the following statements is

Q6: What are the three types of transactions

Q10: The global financial crisis of 2007-2008 resulted

Q22: The main problem with securitization is that<br>A)governments

Q34: When compared with China,the growth of clothing

Q38: Is a depreciation of the dollar/euro exchange

Q58: Under fixed exchange rates,which one of the

Q87: What structures make up the international capital