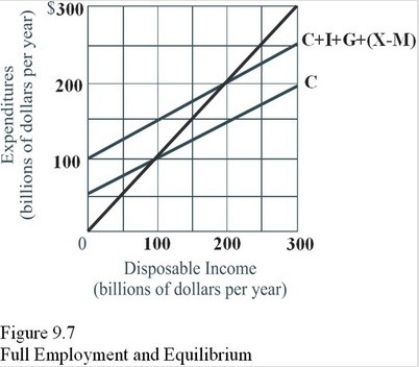

Given the information in Figure 9.7,dissaving would occur at all income levels below

Definitions:

Expected Capital Gains Yield

The anticipated rate of return from an investment due to an increase in its market price.

Reinvestment Rate Risk

Occurs when a short-term debt security must be “rolled over.” If interest rates have fallen, the reinvestment of principal will be at a lower rate, with correspondingly lower interest payments and ending value.

High-Coupon Bonds

Bonds that offer a higher-than-average interest rate (coupon) compared to others in the market, reflecting potentially higher risk.

Low-Coupon Bonds

Low-Coupon Bonds are bonds that have a lower interest rate than the prevailing market interest rate, typically making them sell at a discount to their face value.

Q18: If aggregate demand decreases and aggregate supply

Q21: Which of the following is considered a

Q31: Table 9.1 <span class="ql-formula" data-value="\begin{array}

Q47: Studies have shown that unemployment causes<br>A)Increased expenditure

Q48: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5720/.jpg" alt=" Macro equilibrium is

Q54: Suppose there are 4 million people in

Q57: Which of the following forces did Keynes

Q65: The formula for the multiplier is<br>A)1/(1 -

Q119: The unique situation in which the behavior

Q120: How does the multiplier process work when