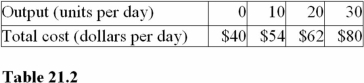

-Average fixed cost at 20 units of output in Table 21.2 is

Definitions:

Depreciation Expense

An accounting method for allocating the cost of a tangible asset over its useful life, representing the asset's consumption.

Accrual Accounting

An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when the cash transaction occurs.

Expenses Recorded

The process of documenting all the money spent during the operation of a business, used to track financial performance and for tax purposes.

Cash Paid

The total amount of cash disbursed by a company for various purposes, such as operating expenses, acquisitions, or investments.

Q7: If all of your friends use the

Q17: For the output levels in Table 21.2,the

Q18: Complete Table 21.5: The average variable cost

Q34: In the short run,when a firm produces

Q46: Price discrimination occurs with products that consumers

Q55: Which of the following is not an

Q76: The payoff to an oligopolist's price cut

Q100: For a competitive firm,the supply curve is

Q112: Greater-than-normal profit represents<br>A)Explicit costs minus implicit costs.<br>B)Payment

Q115: When compared to a competitive market,monopolists tend