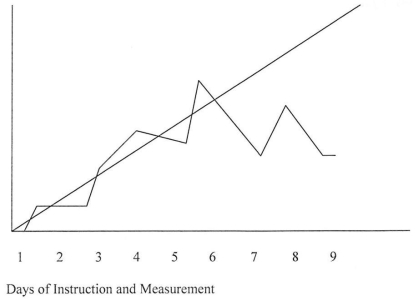

Use the graph below to answer the following questions:

-According to the graph, it could be said that on days 1-6:

Definitions:

Dispersed

Spread out over a wide area; not concentrated in one place.

Grade Distribution

The spread of grades given for a specific academic assessment, typically shown as a frequency distribution.

Chebyshev's Theorem

A statistical rule that gives a minimum proportion of observations that fall within a specified number of standard deviations from the mean, for any distribution.

Empirical Rule

A statistical rule stating that for a normal distribution, nearly all data will fall within three standard deviations of the mean.

Q1: When the RTI committee met to review

Q14: Which of the following options would most

Q16: School district personnel should be aware of

Q18: Which of the following defines the level

Q18: This term means that a student processes

Q42: Which of the following represents a parent's

Q46: Chronological age of examinee

Q50: Which of the following is an example

Q69: Autism diagnoses are decreasing.

Q71: Here is an example of a negative