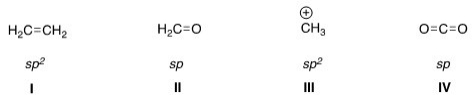

In which structure is the hybridization incorrect?

Definitions:

Marginal Tax Rate

The rate of tax applied to your income for each additional dollar of income, representing the percentage of tax applied to your last dollar of income.

Federal Income Tax

The tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Payroll Taxes

Charges assessed on employers or their employees, typically based on a percentage of the compensation paid to workers.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, influencing individuals' decisions on investment and labor.

Q2: Define the term monetary policy,and describe three

Q5: Which of the following statements about an

Q5: Which of the following molecules are aromatic

Q21: The only two states that are exceptions

Q22: Which of the following is a formal

Q39: The Supreme Court grants certiorari to fewer

Q51: Incumbents may have some problems in reelection

Q58: The Whig theory holds that the presidency<br>A)is

Q63: Poverty is a condition that today affects

Q64: Which of the following resonance structures is