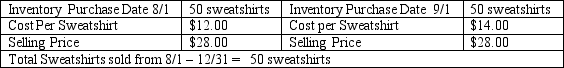

Similar to the example of FIFO and LIFO inventory accounting methods depicted in the Spotlight on Small Business box titled,"What's Coming and Going at the College Bookstore?" a college store purchased sweatshirts for the upcoming fall semester.Using the following data,where a total of 100 sweatshirts were purchased by the store and placed in inventory,select the correct statement from the following choices.

Definitions:

Amortization

The process of gradually writing off the initial cost of an asset over a period, often used for intangible assets.

Corridor

A method used in pension accounting to amortize certain actuarial gains and losses over time.

Unrecognized Loss

A loss that has occurred but has not yet been reported in the financial statements because it has not been realized through a transaction.

Amortization

A process of spreading out a loan's cost over its lifespan, reducing the value of an intangible asset or debt over a specified period.

Q7: An unsecured corporate bond is known as

Q12: Jackson Plumbing,a medium-sized company,wants to guarantee that

Q34: Jim works in the accounting department at

Q36: The Balance Sheet for Renuvation LLC shows

Q68: Bark Three Times Pet Store's owner is

Q216: The Music Museum,LLC sells a unique assortment

Q245: A problem with the corporate distribution system

Q264: As a first step in the accounting

Q304: A sales agent is an agent who

Q323: The Barkley Company will refer to its