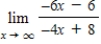

Find the limit.

Definitions:

Marginal Tax Rate

The tax rate applied to the last dollar of income, representing the rate at which additional income is taxed.

Taxable Income

The portion of an individual’s or corporation's income that is subject to taxes by the government.

Average Tax Rate

The ratio of the total taxes paid to the overall income, found by dividing the aggregate amount paid in taxes by the total income.

Income Tax Schedule

A chart or formula used to determine the tax rate applied to various levels of income.

Q18: The Cascade Machining Co has the following

Q40: A business model attempts to minimize problems

Q41: Which one of the following statements

Q41: The Trey Company experienced a $100,000 shortfall

Q49: The market share variance is more controllable

Q74: The base of a solid is bounded

Q88: Find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7497/.jpg" alt="Find for

Q103: Find all relative extrema of the function

Q153: Evaluate the following definite integral by the

Q173: Find an equation of the tangent line