A calculator may not be used on this part of the examination.

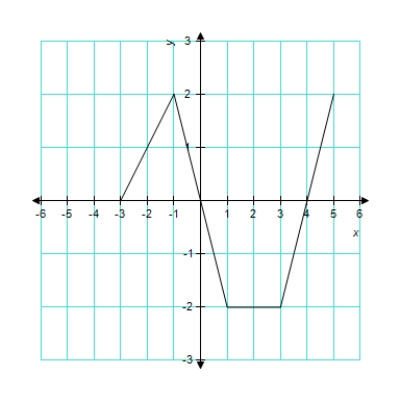

The graph of  consists of four line segments as shown below.Let g be the function given by

consists of four line segments as shown below.Let g be the function given by  .Use this information for Problems 26-28.

.Use this information for Problems 26-28.

-What is  ?

?

Definitions:

Dynamic Hedging

A strategy that involves adjusting the hedge position dynamically as market conditions change, used to manage risk in trading portfolios.

Static Hedging

A financial strategy that involves setting up a position in options or other securities to mitigate risk, without needing to adjust the position frequently.

Capital Outlay

The amount of money spent on acquiring or improving fixed assets, such as buildings, equipment, and land.

Black-Scholes Option-pricing Model

A mathematical model for pricing European call and put options, using factors like the stock's price, exercise price, risk-free rate, and time to expiration.

Q17: Paro Products Co.has provided the following information

Q24: Find the limit (if it exists).

Q43: Determine the point(s)of inflection for <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7497/.jpg"

Q53: Which of the following statement(s)is/are true? (A)If

Q69: Which of the following is false for

Q74: Discuss the continuity of the function <img

Q84: What is the slope of the line

Q95: The difference between operating profits in the

Q111: What is the value of g(2)if

Q117: Find the value of c guaranteed by