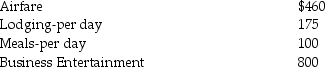

Richard traveled from New Orleans to New York for both business and vacation.He spent 4 days conducting business and some days vacationing.He incurred the following expenses:

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

What is his miscellaneous itemized deduction (before the floor),assuming Richard is an employee and is not reimbursed,under the following two circumstances?

a.He spends three days on vacation,in addition to the business days.

b.He spends six days on vacation,in addition to the business days.

Definitions:

Inputs

Resources, information, or energy that is put into a system or process to achieve output or results.

Processes

Sequences of activities or steps designed to achieve a specific outcome or goal.

Task Performance

The execution and completion of specific duties or responsibilities that contribute to the achievement of a goal.

Storming Stage

The second phase in group development characterized by conflict and competition as group members begin to express differing opinions and establish their roles.

Q3: When the taxpayer anticipates a full recovery

Q9: Which of the following compounds is a

Q11: Methane gas,CH<sub>4</sub>,effuses through a barrier at a

Q14: Rank F,Cl,and Br in order of increasing

Q15: Use VSEPR theory to predict the molecular

Q38: A sole proprietor paid legal fees in

Q60: Sacha purchased land in 2010 for $35,000

Q117: Taxpayers may not deduct interest expense on

Q128: If a prepayment is a requirement for

Q138: Pat is a sales representative for a