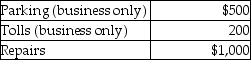

Chelsea,who is self-employed,drove her automobile a total of 20,000 business miles in 2016.This represents about 75% of the auto's use.She has receipts as follows:  Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

Definitions:

Hindbrain

The hindbrain is a part of the vertebrate brain that includes structures such as the cerebellum, pons, and medulla oblongata, and is involved in coordinating functions like balance, motor skills, sleep, and breathing.

Breathing

The process of inhaling and exhaling air to facilitate gas exchange within the body, primarily oxygen intake and carbon dioxide expulsion.

Blood Pressure

The force exerted by circulating blood on the walls of blood vessels, often measured for health assessments.

Cerebellum

A major structure of the hindbrain that controls fine motor skills, balance, coordination, and proprioception.

Q14: Rank F,Cl,and Br in order of increasing

Q22: If an employee incurs travel expenditures and

Q37: While points paid to purchase a residence

Q40: A small business uses the accrual method

Q51: What mass of oxygen is present in

Q53: Mingming is planning to purchase a new

Q60: Sacha purchased land in 2010 for $35,000

Q105: If a taxpayer disposes of an interest

Q125: American Healthcare (AH),an insurance company,is trying to

Q129: Paul,a business consultant,regularly takes clients and potential