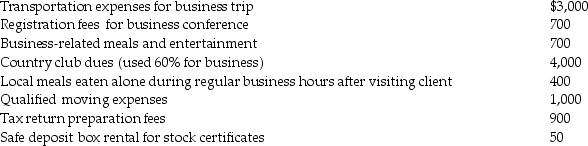

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Gross Profits

The difference between revenue and the cost of goods sold before deducting overhead, payroll, taxes, and interest payments.

Payoff Table

A decision-making tool that summarizes the outcomes of different decisions, given various states of nature, in a tabular format.

Optimal Alternative

The best possible choice among various options under consideration, often based on specific criteria or outcomes.

Expected Opportunity Loss

A statistical concept that calculates the expected amount of loss for not choosing the best alternative.

Q10: Losses on the sale of property between

Q21: To be tax deductible,an expense must be

Q21: At what temperature does 1.00 atm of

Q25: Which of the following ions have the

Q29: A chemical reaction in a bomb calorimeter

Q31: Which of the following are a

Q36: A solid with a mass of 19.3

Q42: An employer contributing to a qualified retirement

Q102: Nina includes the following expenses in her

Q125: Clayton contributes land to the American Red