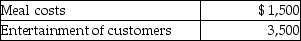

Steven is a representative for a textbook publishing company.Steven attends a convention which will also be attended by many potential customers.During the week of the convention,Steven incurs the following costs in entertaining potential customers.  Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Having recently been to a company seminar on tax laws,Steven makes sure that business is discussed at the various dinners,and that the entertainment is on the same day as the meetings with customers.Steven is reimbursed $2,000 by his employer under an accountable plan.Steven's AGI for the year is $50,000,and while he itemizes deductions,he has no other miscellaneous itemized deductions.What is the amount and character of Steven's deduction after any limitations?

Definitions:

Replacement

The act of substituting a person or thing with another person or thing that serves the same purpose or function.

Restitution

The act of compensating for loss, damage, or injury; in legal contexts, it often refers to returning the victim to their original position before the harm occurred.

Quasi Contract

A legal concept where a court enforces an obligation between two parties who have not agreed to an actual contract, to prevent one party from being unjustly enriched.

Oral Contracts

Agreements between parties that are made verbally and not memorialized in writing, yet are still legally binding in many cases.

Q8: What is the total capacity of electrons

Q13: The molar masses of helium and oxygen

Q19: How many lone pairs of electrons are

Q34: Which of the following compounds is least

Q36: According to the Bohr model for the

Q64: A bona fide debtor-creditor relationship can never

Q84: Which of the following conditions would generally

Q110: Due to stress on the job,taxpayer Fiona

Q114: Gayle,a doctor with significant investments in the

Q121: Travel expenses related to foreign conventions are