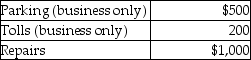

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2016.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Definitions:

Q4: If the outdoor temperature is 17.0°C,what is

Q6: An extensive property is<br>A) used to identify

Q7: Which of the following samples contains the

Q7: How many sigma and pi bonds are

Q7: Frank is a self-employed CPA whose 2016

Q7: Acetylene,C<sub>2</sub>H<sub>2</sub>,is a gas used in welding.The molar

Q25: Which of the following is true about

Q40: How many joules are equivalent to 1.50

Q81: One of the requirements which must be

Q93: Laura,the controlling shareholder and an employee of