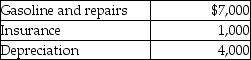

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Definitions:

Less Developed Countries

Countries with a lower level of material wealth, economic activity, and quality of life, often characterized by low GDP per capita and human development indices.

Production Predominates

A condition where the manufacturing or creation of goods is the dominant economic activity in a particular area or sector.

Savings Rate

The percentage of income that is not spent on consumption but instead is saved or invested for future use.

Federal Budget Deficit

Occurs when the government's expenditures exceed its revenues in a fiscal year, leading to the need for borrowing to finance the gap.

Q5: Explain when the cost of living in

Q13: Harley,a single individual,provided you with the following

Q13: Tia is a 52-year-old an unmarried taxpayer

Q18: In general,atomic radii<br>A) increase down a group

Q23: The molar enthalpies of formation for H<sub>2</sub>O(l)and

Q29: Which of the following statements is incorrect

Q30: What is the mass (in grams)of a

Q37: Ammonia gas is produced commercially from the

Q61: Erin,Sarah,and Timmy are equal partners in EST

Q119: A change to adjusted gross income cannot