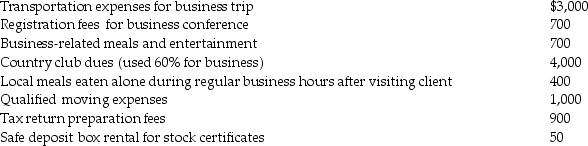

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Definitions:

Adolescence

The developmental period between childhood and adulthood, marked by physical, psychological, and social changes.

Gender Biased

Having or showing an unfair tendency to believe that one gender is better or more important than the other.

Carol Gilligan

An American feminist, ethicist, and psychologist best known for her work on ethical community and ethical relationships, and certain subject-object problems in ethics.

Moral Development

The process through which individuals develop proper attitudes and behaviors towards other people in society, based on social and cultural norms, rules, and laws.

Q4: Carbon and oxygen react to give carbon

Q5: What is the hybridization of the central

Q9: The vacation home limitations of Section 280A

Q16: Which term best describes rocks,such as granite

Q39: What hydrate is sometimes referred to as

Q62: In March of the current year,Marcus began

Q68: Determine the net deductible casualty loss on

Q83: In 2016,Carlos filed his 2015 state income

Q105: Riva borrows $10,000 that she intends to

Q110: An expense is considered necessary if it