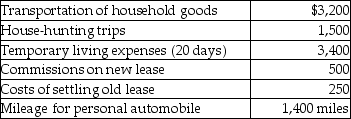

Ron obtained a new job and moved from Houston to Washington.He incurred the following moving expenses:  Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Assuming Ron is eligible to deduct his moving expenses,what is the amount of the deduction?

Definitions:

Social

Pertaining to society or its organization.

Mastery Orientation

A belief that success stems from trying hard and that failures are influenced by factors that can be controlled, like effort.

Growth Mindset

Viewing one’s skills and characteristics as malleable or changeable.

Internal Explanations

The attribution of an individual's behavior to internal characteristics or dispositions rather than external circumstances.

Q1: Which of the balanced chemical equations is

Q11: Place the following atoms or ions in

Q19: David acquired an automobile for $30,000 for

Q23: Jorge contributes $35,000 to his church and

Q28: If an NOL is incurred,when would a

Q56: An individual taxpayer has negative taxable income

Q63: Matt paid the following taxes this year:

Q74: There are several different types of qualified

Q123: Acquisition indebtedness for a personal residence includes

Q141: Pamela was an officer in Green Restaurant