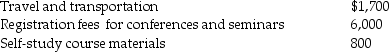

Ellie,a CPA,incurred the following deductible education expenses to maintain or improve her skills:

Ellie's AGI for the year is $60,000.

Ellie's AGI for the year is $60,000.

a.If Ellie is self-employed,what are the amount of and the nature of the deduction for these expenses?

b.If,instead,Ellie is an employee who is not reimbursed by his employer,what are the amount of and the nature of the deduction for these expenses (after limitations)?

Definitions:

Beliefs and Attitudes

Internal thoughts and feelings that shape one's worldview and reactions to various situations.

Parents Influence

The impact that parents have on their children’s development, behavior, and choices through their actions, teachings, and interactions.

Coping with Anxiety

Strategies or practices employed to manage and reduce anxiety.

Middle Childhood

A developmental stage ranging from about 6 to 12 years old, characterized by significant growth in social, cognitive, and physical areas.

Q9: What is the mass percent of each

Q15: Atomic dimensions are often reported in Ångstroms

Q19: A charitable contribution in excess of the

Q25: Patrick and Belinda have a twelve year

Q25: Rick sells stock of Ty Corporation,which has

Q31: Stacy,who is married and sole shareholder of

Q42: What is the net ionic equation for

Q74: There are several different types of qualified

Q93: Lisa loans her friend,Grace,$10,000 to finance a

Q97: All of the following are deductible as