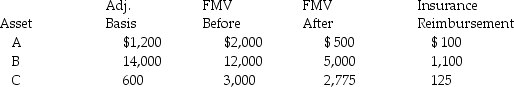

Determine the net deductible casualty loss on the Schedule A for Alan Michael when his adjusted gross income was $40,000 in 2016 and the following occurred:

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

A and B were destroyed in the same casualty in March.C was destroyed in a separate casualty in July.

All casualty losses were nonbusiness personal use property losses and none occurred in a federally declared disaster area.

What is the amount of the net deductible casualty loss?

Definitions:

Pony

A small horse breed with a distinctive gentle disposition and sturdy build, often used for riding and educational purposes.

False Beliefs

Convictions or assumptions held by individuals that are contrary to known facts or evidence.

Not Egocentric

The ability to understand and be concerned with the perspectives and needs of others, rather than being focused solely on oneself.

Child

A young human being below the age of puberty or below the legal age of majority.

Q3: How many elements are contained in period

Q15: A sample of carbon dioxide is collected

Q17: Britney is beneficiary of a $150,000 insurance

Q45: During the current year,Paul,a single taxpayer,reported the

Q57: Two isotopes of chlorine are found in

Q61: A qualified pension plan requires that employer-provided

Q63: What must an individual taxpayer prove to

Q83: Which of the following is most likely

Q122: Kate subdivides land held as an investment

Q133: Losses are generally deductible if incurred in